montana sales tax rate 2020

Learn about Montana tax rates rankings and more. Jul 29 2020 When calculating the sales tax for this purchase Steve applies the 46 state tax rate for Nevada plus 355 for Clark countys tax rate.

How Much Does Your State Rely On Sales Taxes Tax Foundation

There are a total of 68 local.

. State State Tax Rate Rank Avg. Billings MT Sales Tax Rate. State.

The Montana income tax has seven tax brackets with a maximum marginal income tax of 690 as of 2022. This is the total of state county and city sales tax rates. This is the total of state county and city sales tax rates.

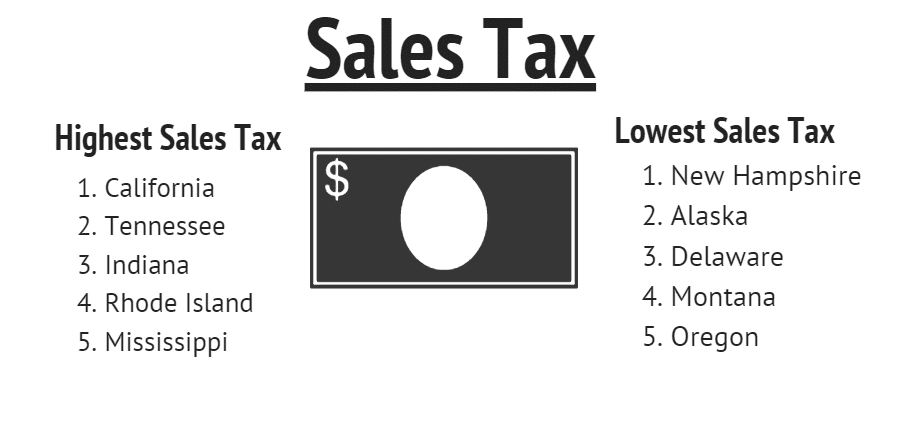

Detailed Montana state income tax rates and brackets are available on this page. These rates are weighted by population to compute an average local tax rate. Montana has no state sales tax and allows local governments to collect a local option sales tax of up to NA.

Montana has a 0 statewide sales tax rate but also has 69 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0002 on top. Sources of State and Local Tax Collections. Tax rate of 5 on taxable income between 12001 and 15400.

Local Tax Rate Combined Rate Rank Max Local Tax Rate. Download all Montana sales tax rates by zip code. Pondera County MT Sales Tax Rate.

The State of Alabama has a program for simplified sellers use tax SSUT under Statute 40-23-192. Montana is one of only five states without a general sales tax. The Montana MT state sales tax rate is currently 0.

As of July 1 2020. Up to 10 Montana counties including Granite Sheridan Madison Gallatin Mineral Sanders Hill Valley Cascade and Flathead could approve new local taxes on recreational. Bozeman MT Sales Tax Rate.

Jan 01 2020 Nevada Sales Tax. Powell County MT Sales Tax Rate. State Local Sales Tax Rates As of January 1 2020 a City county and municipal rates vary.

Explore data on Montanas income tax sales tax gas tax property tax and business taxes. 2022 Montana state sales tax. The Montana Department of Revenue is responsible for publishing the latest Montana State Tax Tables each year as part of its duty to efficiently and effectively administer the revenue laws in.

The Montana State Montana sales tax is NA the same as the Montana state sales tax. Bigfork MT Sales Tax Rate. 368 rows Average Sales Tax With Local.

Phillips County MT Sales Tax Rate. The current total local sales tax rate in Yellowstone County MT is 0000. What is the sales tax rate in Missoula Montana.

Belgrade MT Sales Tax Rate. Nevadas statewide sales tax rate of 685 is seventh-highest in the US. Tax rate of 6 on taxable income between.

The minimum combined 2022 sales tax rate for Bozeman Montana is. Powder River County MT Sales Tax Rate. The Montana sales tax rate is currently.

At a total sales tax rate of. The Montana state sales tax rate is 0 and the average MT sales tax after local surtaxes is 0. The minimum combined 2022 sales tax rate for Missoula Montana is.

The County sales tax. While many other states allow counties and other. As of 2022-11-09 060947am.

Tax rate of 4 on taxable income between 8901 and 12000. It is the mission of the Business and Income Tax Division to contribute to the effective administration of taxes fees and other revenue sources administered by the Department of. Local sales tax rates can raise the sales.

Butte MT Sales Tax Rate. Exact tax amount may vary for different items. The state sales tax rate in Montana is 0 but you can customize this table as needed to reflect your applicable local sales tax rate.

U S States With No Sales Tax Taxjar

Sales Taxes In The United States Wikipedia

Economic Nexus State Chart State By State Economic Nexus Rules Sales Tax Institute

.jpg)

Hvs 2021 Hvs Lodging Tax Report Usa

Fuel Taxes In The United States Wikipedia

Montana Tax Information Bozeman Real Estate Report

Problems With A Statewide Sales Tax Montana Needs To Help Not Hurt Families Montana Budget Policy Center

Montana Sales Tax Rates Avalara

Montana Income Tax Information What You Need To Know On Mt Taxes

Ci 121 Montana S Big Property Tax Initiative Explained

Montana Income Tax Calculator Smartasset

Cities With The Lowest Tax Rates Turbotax Tax Tips Videos

State Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation

States Without Sales Tax Article

How Do State And Local Property Taxes Work Tax Policy Center

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)

States With Minimal Or No Sales Taxes

Statewide Report Simple Left Nav Montana State University

How Do State And Local Sales Taxes Work Tax Policy Center

The 10 States With The Highest Tax Burden And The Lowest Zippia